Strategic Trading: The Role of CFDs in Modern Investment Portfolios

Cfd trading, or Contract for Difference trading, is a popular and rapidly growing market that can offer significant financial rewards. Using leverage, traders can profit by making accurate predictions about the price movements of a range of financial assets, including forex, commodities, indices, and shares. Cfd trading has become popular mainly because of the opportunities it presents for earning profits, with returns rapidly outpacing those offered by traditional investments. In this blog post, we will delve into the basics of Cfd trading, discussing how it works, its main benefits, as well as risks involved. So, buckle up and learn more about the exciting world of cfd trading.

How does Cfd trading work?

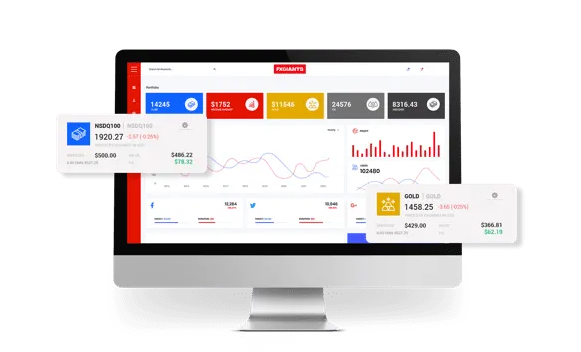

Cfd trading operates through a contract between two parties – a buyer and a seller. The buyer agrees to pay the seller the difference between the current value of the asset and its value at the time of the contract’s end. Once the contract expires or is closed, the net difference is paid out in cash without any asset ownership exchange. Leverage is a key feature of Cfd trading that allows users to invest greater sums than their account would typically allow, potentially increasing the profits they make. To trade CFD, investors must first select a broker; some of the most popular in the market include Plus500, IG, and eToro.

What are the benefits of Cfd trading?

One of the primary benefits of Cfd trading is that it allows for increased profitability. CFD contracts are typically leveraged, with traders requiring only a small percentage of the total value of the asset they wish to purchase. Each CFD contract is also a short-term investment, meaning that investors can potentially see significant returns in just a few hours or days. Additionally, investors can access a wide range of both national and international markets and trade in a variety of financial assets.

What are the risks of Cfd trading?

Cfd trading comes with significant risks. Leverage can magnify gains, but it can also magnify losses, meaning that investors can lose more than their initial investment. Additionally, as with all trading, the value of an asset can be unpredictable and change dramatically. Because of such risks, high levels of knowledge about market analysis, and research skills are needed to correctly predict a market’s trends.

How to manage risks in Cfd trading?

While traders cannot avoid all risks of Cfd trading, several steps can be taken to manage such risks. First, investors must choose a reputable broker offering negative balance protection. This ensures that a trader cannot lose more than the deposit invested. Investors should also use stop-loss orders, which automatically close trades if the asset’s price falls below a certain level, to limit their losses. Finally, traders must avoid ‘over-trading’ by ensuring they have a well-thought-out strategy, a solid exit plan, and appropriate risk management protocols in place to minimize their risks.

short:

In short, Cfd trading is an exciting, profitable, and increasingly popular way to invest. Using leverage and short-term trades, CFD traders can make significant returns, accessing a range of national and international markets. However, Cfd trading also comes with significant risks that can exceed the initial deposit. Hence, traders need to undertake their due diligence when investing in Cfd trading. As in all trading, they must be cautious, informed, and know-how to evaluate the market trends that best suit their investment goals.